Research

(Hide Abstracts)

Journal Articles

|

"Nonbank Lenders as Global Shock Absorbers: Evidence from US Monetary Policy Spillovers" Journal of International Economics, forthcoming [link] [Chicago FED WP]

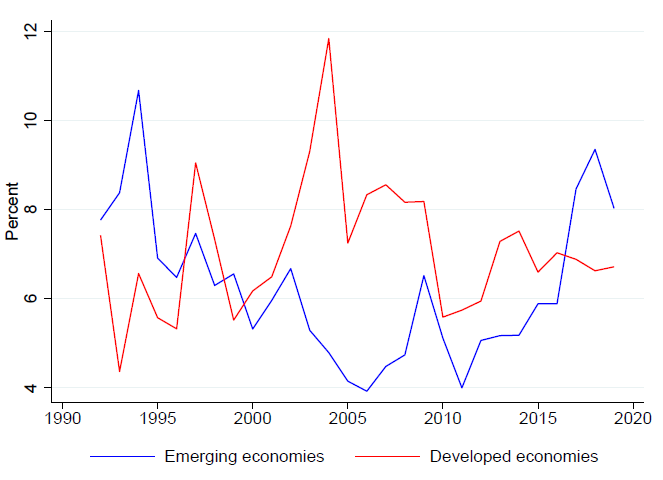

with David Elliott and José-Luis Peydró We show that nonbank lenders act as global shock absorbers from US monetary policy tightening spillovers. For identification, we use loan-level data from the global syndicated lending market and US monetary policy surprises. We nd that when US monetary policy tightens, nonbank lenders increase the supply of dollar credit to non-US borrowers, relative to banks. This partially mitigates the total reduction in dollar credit supply. The substitution is stronger for riskier borrowers, emerging market borrowers, and borrowers from non-dollar-anchored countries. However this increased risk-taking is not associated with more fragile nonbank lenders or with zombie lending. Moreover, the relative expansion of nonbank lending is affected by prudential regulation. Finally, the credit substitution has real effects, as borrowers with existing relationships with nonbank lenders increase total debt, investment, and employment. Our results therefore suggest that having more diversified funding providers (nonbanks in addition to banks) reduces the volatility in capital flows and economic activity resulting from the global financial cycle. |

|

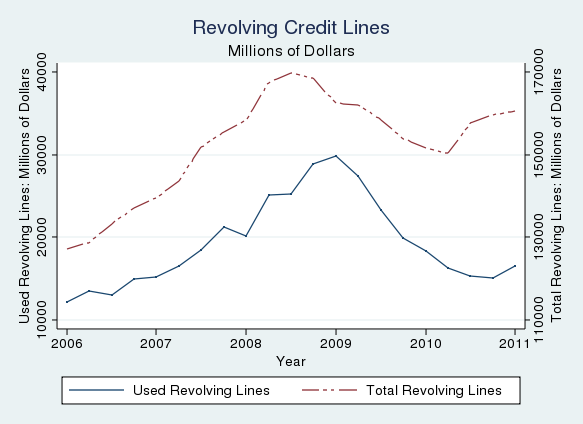

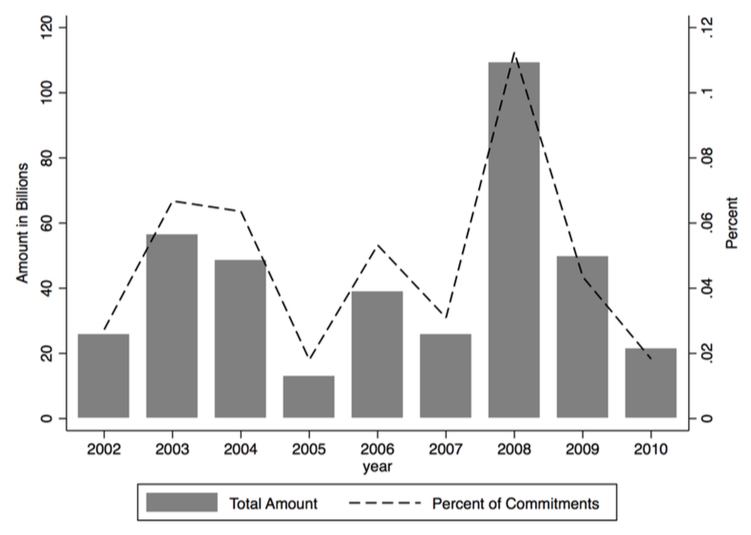

“The Real Effects of Credit Line Drawdowns.” International Journal of Central Banking (2022) Vlo. 18(3), pp.321-397. [link][FEDS WP] [latest version]

Best Paper Prize at the 6th International Finance and Banking Society Conference with Jose Berrospide Using a unique dataset of 467 public firms with credit lines, we study the purpose of drawdowns during the 2007-2009 financial crisis. Our data show that credit line drawdowns had already increased in late-2007. Our results confirm that firms use drawdowns to sustain investment after an idiosyncratic liquidity shock. Using an instrumental variable approach, we find that a one standard deviation increase in credit line drawdowns is associated with an increase of 9 percent in capital expenditures. During the financial crisis, this effect increased to 16 percent. We find only limited evidence that drawdowns were used to boost cash holdings. |

|

“The Rise of Shadow Banking: Evidence from Capital Regulation.” Review of Financial Studies (2021) Vol. 34(5), pp. 2181-2235 - Editor's Choice [link][CEPR WP] [FEDS WP][latest version]

with Rustom Irani, Rajkamal Iyer, and José-Luis Peydró We investigate the connections between capital regulation and the prevalence of lightly regulated nonbanks (shadow banks) in the U.S. corporate loan market. For identification, we exploit an administrative, supervisory credit register of syndicated loans, loan-time fixed effects, and plausibly exogenous variation in regulatory bank capital arising from the U.S. implementation of Basel III. We find that less-capitalized banks reduce loan retention and nonbanks fill the void. Stronger effects exist among loans with higher capital requirements, at times when capital is scarce, and for banks with higher unexpected capital requirements stemming from Basel III. Finally, we document an important consequence of this credit reallocation: loans funded by nonbanks---especially those with fragile funding---experience greater turnover and secondary market price volatility during the 2008 period of marketwide stress. |

|

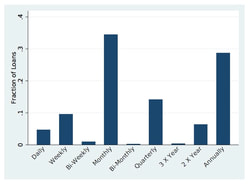

“Banks Monitoring: Evidence from Syndicated Loans.” Journal of Financial Economics (2021) Vol. 139(2), pp. 452-477. [link][Final version]

with Matthew Gustafson and Ivan Ivanov We directly measure banks' monitoring of syndicated loans. Banks typically demand borrower information on at least a monthly basis. About 20% of loans involve active monitoring (i.e., site visits). Monitoring increases with the lead bank's incentives and the value of information. For instance, banks increase monitoring following arguably exogenous changes in the lead share, worsening borrower financial condition, and large credit line drawdowns. Loan covenants and monitoring can be either substitutes or complements depending on whether monitoring informs covenant compliance. Additional tests suggest that bank monitoring generates actionable information, which helps to preempt covenant violations or facilitate renegotiations. |

|

“Pipeline Risk in Leveraged Loan Syndication.” Review of Financial Studies (2020) Vol. 33(12), pp. 5660–5705. [link][Final Version]

with Max Bruche and Frederic Malherbe What is the economic role played by arrangers of leveraged loans, and what are the risks they face? We provide evidence that arrangers solve a demand discovery problem. Investors have incentives to feign little interest in the loan to obtain better terms. To deter such behaviour, arrangers underprice hot deals and ration investors on cold deals. The risk associated with demand discovery is often shared between borrowers and arrangers. One implication is that to ration investors on cold deals, arrangers retain larger loan shares. This motive for retention is different from the monitoring incentive motive considered in the literature. |

|

“Public Goods Institutions, Human Capital, and Growth: Evidence from German History” Review of Economic Studies (2020) Vol. 87(2), pp. 959-996. [link][CEP WP] [FEDS WP][Final Version]

with Jeremiah Dittmar previously circulated as “State Capacity and Public Goods: Institutional Change, Human Capital, and Growth in Early Modern Germany.” (2016) CEP Discussion Paper No 1418. What are the origins and consequences of the state as a provider of public goods? We study legal reforms that established mass public education and increased state capacity in German cities during the 1500s. These fundamental changes in public goods provision occurred where ideological competition during the Protestant Reformation interacted with popular politics at the local level. We document that cities that formalized public goods provision in the 1500s began differentially producing and attracting upper tail human capital and grew to be significantly larger in the long-run. We study plague outbreaks in a narrow time period as exogenous shocks to local politics and find support for a causal interpretation of the relationship between public goods institutions, human capital, and growth. More broadly, we provide evidence on the origins of state capacity directly targeting welfare improvement. |

|

“Loan Sales and Bank Liquidity Management: Evidence from a U.S. Credit Register,” Review of Financial Studies (2017) Vol. 30(10), pp. 3455-3501. [link] [FEDS WP]

with Rustom Irani We examine how banks use loan sales to manage liquidity during periods of marketwide stress and the associated spillovers to market prices. We track the dynamics of loan share ownership in the secondary market using data from a U.S. supervisory register of syndicated loans. Controlling for loan quality using loan-year fixed effects, we find that banks reliant on wholesale funding were more likely to exit syndicates through sales during 2007/08. This effect is stronger for banks dependent on short-term funding and holding fewer liquid securities. In addition, secondary market prices decrease significantly more for loans funded by liquidity-strained banks. |

|

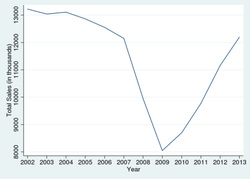

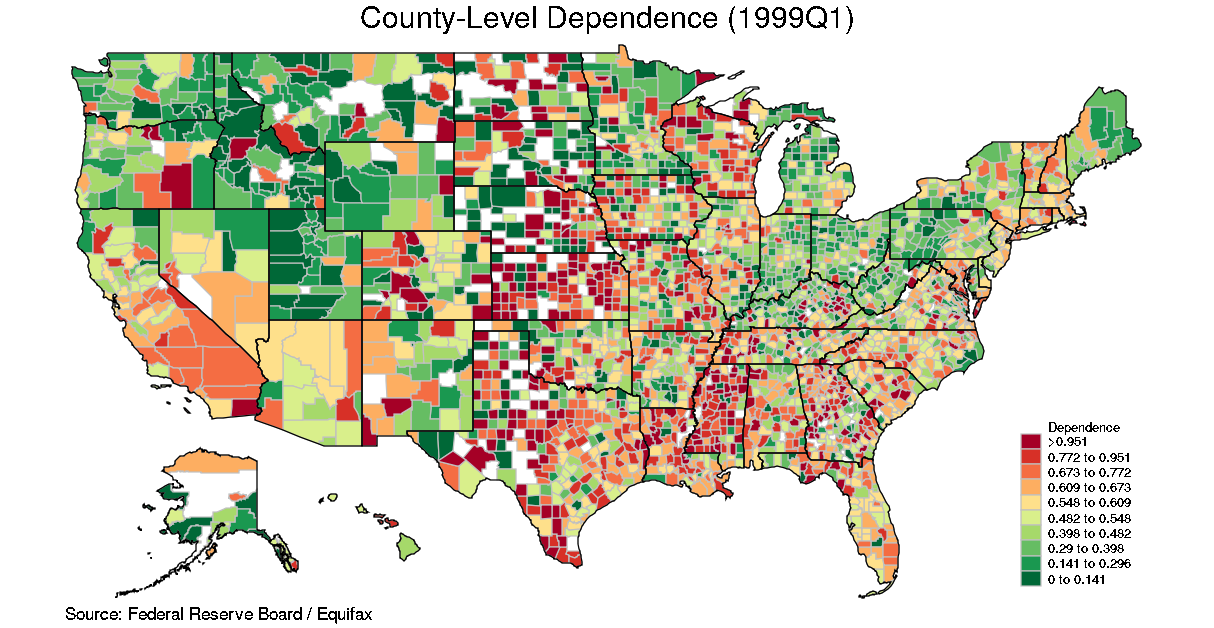

“The Real Effects of Liquidity During the Financial Crisis: Evidence from Automobiles.” Quarterly Journal of Economics (2017). Vol 132(1), pp. 317-365 [link] [NBER WP]

with Efraim Benmelech and Rodney Ramcharan Illiquidity in short-term credit markets during the financial crisis might have severely curtailed the supply of non-bank consumer credit. Using a new data set linking every car sold in the United States to the credit supplier involved in each transaction, we find that the collapse of the asset-backed commercial paper market reduced the financing capacity of such non-bank lenders as captive leasing companies in the automobile industry. As a result, car sales in counties that traditionally depended on non-bank lenders declined sharply. Although other lenders increased their supply of credit, the net aggregate effect of illiquidity on car sales is large and negative. We conclude that the decline in auto sales during the financial crisis was caused in part by a credit supply shock driven by the illiquidity of the most important providers of consumer finance in the auto loan market. These results also imply that interventions aimed at arresting illiquidity in short-term credit markets might have helped to contain the real effects of the crisis. |

|

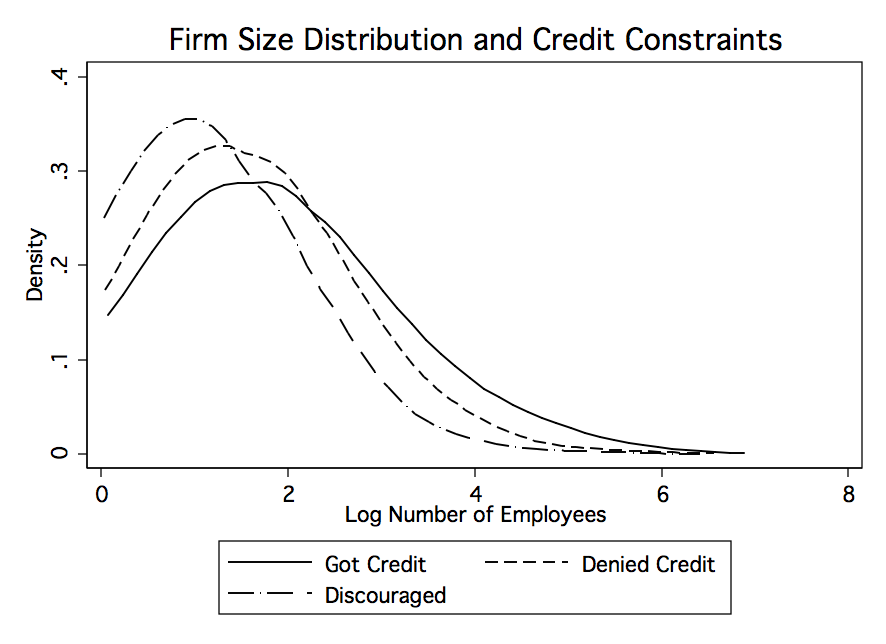

“Can Financing Constraints Explain the Evolution of the Firm Size Distribution?” Review of Industrial Organization (2016), Vol. 48(2), pp. 123-147. [link]

This paper exploits a comprehensive data set on business credit decisions to examine the importance of financing constraints for the evolution of the firm size distribution. The survey of small business finances provides information on whether a firm was in need of external financing. Firms without access to external financing—either because they were denied credit or because they did not apply for credit because they expected to be denied credit—are significantly smaller. To tighten the link between financing constraints and firm dynamics, I estimate the effect of financing constraints on subsequent employment growth and find that firms without access to external financing exhibit up to 3.5 % points lower annual employment growth than do their unconstrained counterparts. These findings suggest that financing constraints are a potentially important factor for understanding firm dynamics. |

|

“Organization Matters: Trade Union Behavior in Peace and War.” Journal of Comparative Economics (2015), Vol. 43(4), pp. 919-937. [link]

This paper employs a comparative institutional analysis to explain the origins of different trade union organizational structures in Germany and Great Britain as of 1913 and their macroeconomic implications. It shows that complementarities between the structures of employer and union organizations account for these differences. Therefore, I model coordinated industry-wide unions and centralized employer organizations in Germany and fragmented unions and decentralized employer organizations in Britain as two equilibria of a union–employer game. I use World War I as a natural experiment to study the impact of union structure on union strategies and bargaining outcomes during the war in a union–government game and discuss long-run ramifications of the bargaining outcomes. |

|

“Verifying the State of Financing Constraints: Evidence from US Business Credit Contracts,” Journal of Economic Dynamics and Control (2014), Vol. 43, pp. 58-77. [link] [FEDS WP]

Many policymakers are concerned that tight financing constraints for small businesses are stalling the recovery from the Great Recession. This paper empirically assesses two agency problems that induce such financing constraints—one resulting in a “firm balance sheet channel” and one resulting in a “bank balance sheet channel”. Evaluating specific models of these two agency problems against a comprehensive data set of U.S. small business credit contracts, I find strong support for the firm balance sheet channel but only weak support for the bank balance sheet channel. A complementary regression analysis confirms this result. Hence, policies seeking to improve firms’ balance sheets may be desirable to support small business lending in the recovery from the Great Recession. |

|

“The Unreliability of Credit-to-GDP Ratio Gaps in Real-Time: Implications for Counter-Cyclical Capital Buffers.” International Journal of Central Banking (2011), Vol. 7(4), pp. 261-298. [link] [FEDS WP] with Rochelle Edge

Macroeconomists have long recognized that activity-gap measures are unreliable in real time and that this can present serious difficulties for stabilization policy. This paper investigates whether the credit-to-GDP ratio gap, which has been proposed as a reference point for accumulating countercyclical capital buffers, is subject to similar problems. We find that ex post revisions to the U.S. credit-to-GDP ratio gap are sizable and as large as the gap itself, and that the main source of these revisions stems from the unreliability of end-of-sample estimates of the series’ trend rather than from revised estimates of the underlying data. The paper considers the potential costs of gap mismeasurement. We find that the volume of lending that may incorrectly be curtailed is potentially large, although loan interest rates appear to increase only modestly. |

Articles in Edited Volumes

|

“How Britain Lost its Competitive Edge: Competence in the Second Industrial Revolution,” in Institutions, Innovation, and Industrialization: Essays in Economic History and Development (2015), edited by Avner Greif, Lynne Kiesling, and John V.C. Nye. Princeton: Princeton University Press, pp. 307-336.

|

|

“The Rate and Direction of Invention in the British Industrial Revolution: Incentives and Institutions.” in The Rate and Direction of Inventive Activity Revisited (2012), edited by Josh Lerner and Scott Stern. Chicago: University of Chicago Press, pp. 443-479. [NBER WP]

with Joel Mokyr |

Books

|

“Finanzmärkte, Corporate Governance, IuK-Technologien: Treibende Faktoren für den Wandel in der Industrie,” (Financial markets, corporate governance, and information technologies, 2003). ifo Beiträge zur Wirtschaftsforschung, vol. 11, Munich (with Hans-Günther Vieweg, Michael Reinhard, Alfons Weichenrieder, and Bent Nowak).

|

Working Papers

|

How Climate Change Shapes Bank Lending: Evidence from Portfolio Reallocation [link]

We document how bank lending has changed in response to climate change by analyzing changes in bank loan portfolios since 2012. Using supervisory data providing loan-level portfolios of the largest U.S. banks, we nd that banks significantly reduced lending to areas more impacted by climate change starting around 2015. Using flood risk and wild re risk as proxies for climate risk, we estimate a one standard deviation increase in climate risk reduces county-level balances in banks' portfolios by up to 4.7 percent between 2014 and 2020 in counties with large loan balances. The aggregate trend masks considerable heterogeneity. Banks reduced lending more for the riskier loans (HELOCs, CRE) and to borrowers with high credit risk. However, banks expanded lending, including riskier loans, to borrowers with the lowest credit risk in areas more impacted by climate change. |

|

Nonbanks, Banks, and Monetary Policy: U.S. Loan-Level Evidence since the 1990s

with David Elliot, José-Luis Peydró, and Bryce C. Turner [latest version] We analyze the effects of monetary policy on nonbank and bank lending to firms and households since the 1990s. Exploiting U.S. monetary policy shocks and loan-level data, we find that—after a one standard deviation contractionary monetary policy shock—nonbank credit supply expands relative to bank credit supply by 12 percent in the corporate loan market and by 10 percent in the consumer loan and mortgage markets. Effects are stronger for ex-ante riskier loans. In the consumer credit market, the nonbank credit expansion completely offsets the retrenchment by banks. However, overall substitution in corporate loan and mortgage markets is limited due to demand factors. Our results show that nonbank lenders significantly attenuate both—the bank lending and risk-taking channels of monetary policy; however, with substantially different overall credit supply and the associated real effects across markets. Specifically, for the risk-taking channel, nonbanks take more risk in all markets when monetary policy tightens. |

|

The Dollar and Corporate Borrowing Costs

CEPR Working Paper No. 14892 [link][CEPR WP] with Friederike Niepmann and Tim Schmidt-Eisenlohr We show that U.S. dollar movements affect syndicated loan terms for U.S. borrowers, even for those without trade exposure. We identify the effect of dollar movements using spread and loan amount adjustments during the syndication process. Using this high-frequency, within loan variation, we find that a one standard deviation increase in the dollar index increases spreads by up to 15 basis points and reduces loan amounts and underpricing by up to 2 percent and 7 basis points, respectively. These effects are concentrated in dollar appreciations. Our results suggest that global developments reflected in the dollar determine U.S. borrowing costs. |

|

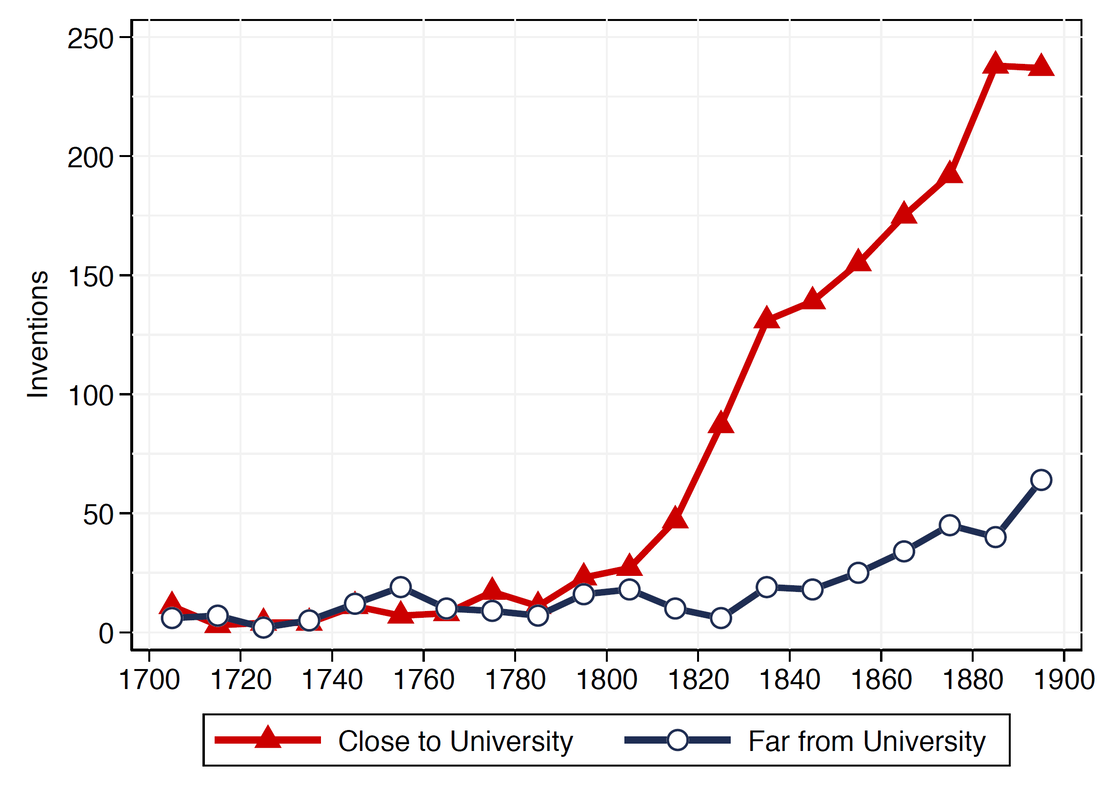

The Research University, Invention, and Industry: Evidence from Germany 1760-1900

with Jeremiah Dittmar [link] We study the role of higher education in promoting the transition to industrial capitalism where modern research universities first developed: nineteenth century Germany. We construct novel microdata on invention, scientific activity, and manufacturing across virtually all towns in Germany between 1760 and 1900. Invention, scientific activity, and manufacturing developed similarly in towns nearer to and farther from universities in the 1700s, and then shifted towards universities and accelerated in the early 1800s. After 1800, we find a significant positive shift in the probability that inventors were educated or employed at universities. Manufacturing in which invention was university-intensive located nearer to universities. These shifts in invention and manufacturing reflected changes in German universities, politics, and culture that were precipitated by the French Revolution and Napoleonic invasion of the early 1800s. |

|

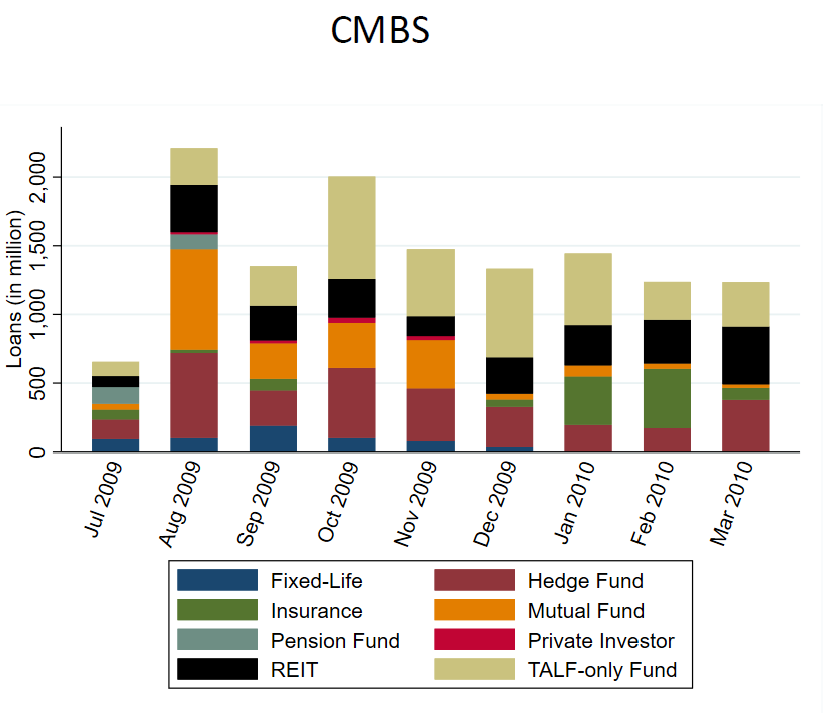

De-Limiting Arbitrage: Evidence from the Term-Asset Backed Securities Loan Facility [link]

with Karen Pence We use the Term Asset-Backed Securities Loan Facility (TALF) crisis liquidity program in which all borrowers, including a broad set of nonbanks, faced the same counterparty and program terms as a laboratory to test the predictions of limits to arbitrage models and their dynamics. Using detailed loan-level data and variation in the risk of assets and constraints of investors, we show that arbitrageurs invest in lower-risk assets than long-term investors during financial crises. As their leverage constraints ease, arbitrageurs gradually increase risk-taking. Spreads widen on assets when arbitrageurs face an exogeneous increase in their leverage constraints. |

|

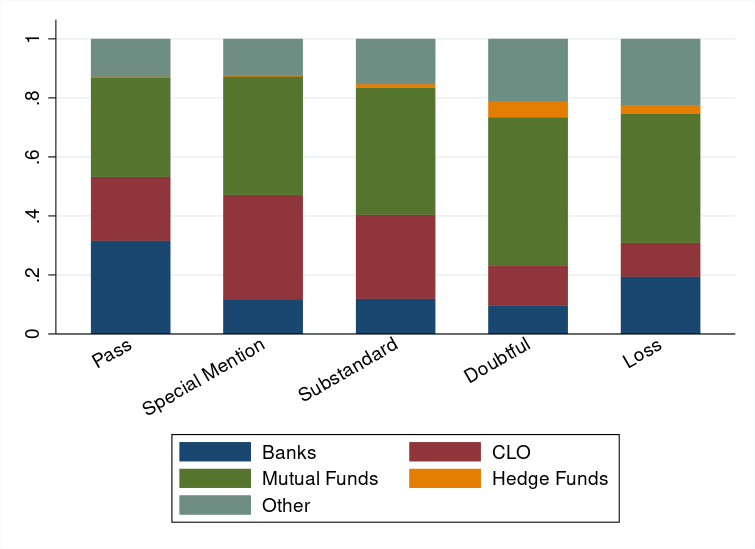

Changes in Ownership and Performance of Deteriorating Syndicated Loans [link]

with Marissunta Giannetti Regulation and capital constraints may force banks and collateralized loan obligations (CLOs) to sell deteriorating loans, potentially hampering renegotiation and amplifying the initial negative shock to the borrower. We show that banks and CLOs sell downgraded loans to mutual funds and hedge funds. The reallocation of loan shares favors the syndicate's concentration increasing lenders' incentives to renegotiate. However, syndicates remain less concentrated when potential buyers experience financial constraints and subsequently loans are less likely to be amended and more likely to be downgraded even further. Our findings indicate that existing regulations may amplify shocks to credit quality during periods of generalized distress in the financial system. |

|

What do Lead Banks Learn from Leveraged Loan Investors? [link]

with Max Bruche and David Xiaoyu Xu In leveraged loan deals, lead banks use bookbuilding to extract price-relevant information from syndicate participants. This paper examines the content of such information. We find that pricing adjustments during bookbuilding are highly informative, not only about investors’ required risk premium but also about borrower quality. A one-percentage-point increase in loan spread predicts a 0.8% higher excess return, a proxy for risk premium, over the first 3 months of secondary market trading. More importantly, it also predicts a 3% higher probability of subsequent default, implying that investors have private information about borrower quality that is unknown to the lead bank. Our findings suggest a new view of how information asymmetries affect syndicated lending. |

Work in Progress

Miscellaneous Publications

"J. Bradford DeLong: Slouching towards Utopia: an economic history of the twentieth century Hachette Book Group, 2022" Book Review, Business Economics, 2023 [link]

"Internal Migration Patterns after the 2008 Financial Crisis: Evidence from a Credit Panel." (with Daniel Gallego), Chicago FED Insights, Nov 16, 2022.[link]

“How the Federal Reserve's central bank swap lines have supported U.S. corporate borrowers in the leveraged loan market” (with Annie McCrone, Friederike Niepmann, and Tim Schmidt-Eisenlohr), FEDS Note, November 12, 2020.[link]

“The lasting impact of epidemics” (with Jeremiah Dittmar), CentrePiece - The Magazine for Economic Performance 594, Centre for Economic Performance, LSE, November 2, 2020. [link]

“How Central Bank Swap Lines Affect the Leveraged Loan Market” (with Annie McCrone, Friederike Niepmann, and Tim Schmidt-Eisenlohr), Chicago Fed Letter, No. 446, September 2020. [link]

"The U.S. Syndicated Term Loan Market: Who holds what and when?," FEDS Note (with Seung Jung Lee, Dan Li, and Martin J. Sicilian), November 25, 2019.[link]

"Household Debt-to-Income Ratios in the Enhanced Financial Accounts" FEDS Note (with Michael Ahn and Mike Batty), January 11, 2018. [link]

"From credit risk to pipeline risk: Why loan syndication is a risky business" VoxEU.org (with Max Bruche and Frederic Malherbe), September 11, 2017. [link]

"Auto Financing during and after the Great Recession" FEDS Note, June 22nd, 2017. [link]

"Funding Agreement-Backed Securities in the Enhanced Financial Account" FEDS Note (with Nathan Foley-Fisher, Borghan Narajabad, Maria G. Perozek, and Stephane H. Verani), August 5th, 2016. [link]

"Impact of the ‘great bailout’: Evidence from car sales" VoxEU.org (with Efraim Benmelech and Rodney Ramcharan), June 11, 2016. [link]

"The origins of growth: How states institutions forged during the Protestant Reformation drove development" VoxEU.org (with Jeremiah Dittmar), April 26, 2016. [link]

“Off-Balance Sheet Items of Depository Institutions in the Enhanced Financial Accounts” FEDS Note, August 28th, 2015. [link]

“The Federal Reserve's Overnight and Term Reverse Repurchase Agreement Operations in the Financial Accounts of the United States” FEDS Note, March 24th, 2015. [link]

“Is education policy innovation policy?” VoxEU.org (with Joel Mokyr), June 13th, 2011. [link]

"Internal Migration Patterns after the 2008 Financial Crisis: Evidence from a Credit Panel." (with Daniel Gallego), Chicago FED Insights, Nov 16, 2022.[link]

“How the Federal Reserve's central bank swap lines have supported U.S. corporate borrowers in the leveraged loan market” (with Annie McCrone, Friederike Niepmann, and Tim Schmidt-Eisenlohr), FEDS Note, November 12, 2020.[link]

“The lasting impact of epidemics” (with Jeremiah Dittmar), CentrePiece - The Magazine for Economic Performance 594, Centre for Economic Performance, LSE, November 2, 2020. [link]

“How Central Bank Swap Lines Affect the Leveraged Loan Market” (with Annie McCrone, Friederike Niepmann, and Tim Schmidt-Eisenlohr), Chicago Fed Letter, No. 446, September 2020. [link]

"The U.S. Syndicated Term Loan Market: Who holds what and when?," FEDS Note (with Seung Jung Lee, Dan Li, and Martin J. Sicilian), November 25, 2019.[link]

"Household Debt-to-Income Ratios in the Enhanced Financial Accounts" FEDS Note (with Michael Ahn and Mike Batty), January 11, 2018. [link]

"From credit risk to pipeline risk: Why loan syndication is a risky business" VoxEU.org (with Max Bruche and Frederic Malherbe), September 11, 2017. [link]

"Auto Financing during and after the Great Recession" FEDS Note, June 22nd, 2017. [link]

"Funding Agreement-Backed Securities in the Enhanced Financial Account" FEDS Note (with Nathan Foley-Fisher, Borghan Narajabad, Maria G. Perozek, and Stephane H. Verani), August 5th, 2016. [link]

"Impact of the ‘great bailout’: Evidence from car sales" VoxEU.org (with Efraim Benmelech and Rodney Ramcharan), June 11, 2016. [link]

"The origins of growth: How states institutions forged during the Protestant Reformation drove development" VoxEU.org (with Jeremiah Dittmar), April 26, 2016. [link]

“Off-Balance Sheet Items of Depository Institutions in the Enhanced Financial Accounts” FEDS Note, August 28th, 2015. [link]

“The Federal Reserve's Overnight and Term Reverse Repurchase Agreement Operations in the Financial Accounts of the United States” FEDS Note, March 24th, 2015. [link]

“Is education policy innovation policy?” VoxEU.org (with Joel Mokyr), June 13th, 2011. [link]