Research

(Show Abstracts)

Journal Articles

|

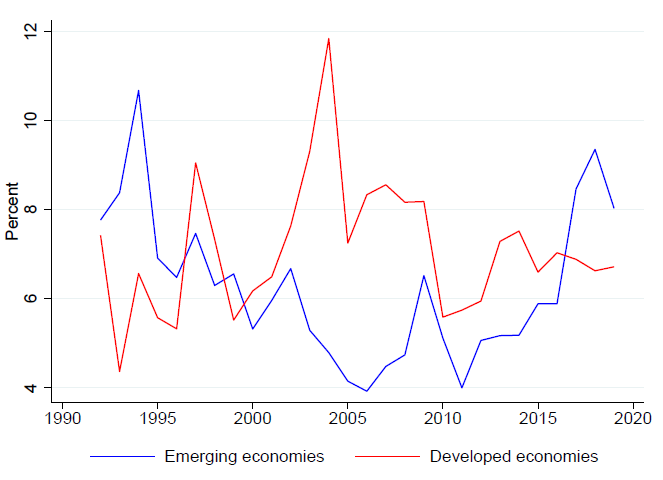

“Nonbank Lenders as Global Shock Absorbers: Evidence from US Monetary Policy Spillovers.” Journal of International Economics, forthcoming [link][Chicago FED WP]

with David Elliott and José-Luis Peydró |

|

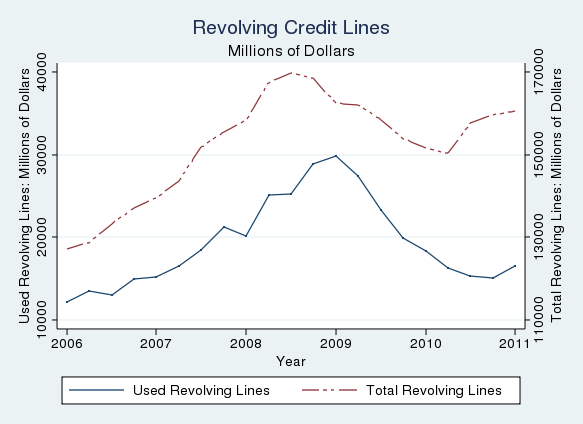

“The Real Effects of Credit Line Drawdowns.” International Journal of Central Banking (2022) Vol 18(3), pp. 321-397. [link][FEDS WP][latest version]

Best Paper Prize at the 6th International Finance and Banking Society Conference with Jose Berrospide |

|

“The Rise of Shadow Banking: Evidence from Capital Regulation.” Review of Financial Studies (2021) Vol. 34(5), pp. 2181-2235. - Editor's Choice [link][CEPR WP] [FEDS WP][latest version]

with Rustom Irani, Rajkamal Iyer, and José-Luis Peydró |

|

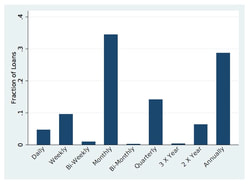

“Banks Monitoring: Evidence from Syndicated Loans.” Journal of Financial Economics (2021) Vol. 139(2), pp. 452-477. [link][Final version]

with Matthew Gustafson and Ivan Ivanov |

|

“Pipeline Risk in Leveraged Loan Syndication.” Review of Financial Studies (2020) Vol. 33(12), pp. 5660–5705. [link][Final Version]

with Max Bruche and Frederic Malherbe |

|

“Public Goods Institutions, Human Capital, and Growth: Evidence from German History” Review of Economic Studies (2020) Vol. 87(2), pp. 959-996. [link][CEP WP] [FEDS WP][Final Version]

with Jeremiah Dittmar previously circulated as “State Capacity and Public Goods: Institutional Change, Human Capital, and Growth in Early Modern Germany.” (2016) CEP Discussion Paper No 1418. |

|

“Loan Sales and Bank Liquidity Management: Evidence from a U.S. Credit Register,” Review of Financial Studies (2017) Vol. 30(10), pp. 3455-3501. [link] [FEDS WP]

with Rustom Irani |

|

“The Real Effects of Liquidity During the Financial Crisis: Evidence from Automobiles.” Quarterly Journal of Economics (2017) Vol. 132(1), pp. 317-365. [link] [NBER WP] [Finaning Share Data]

with Efraim Benmelech and Rodney Ramcharan |

|

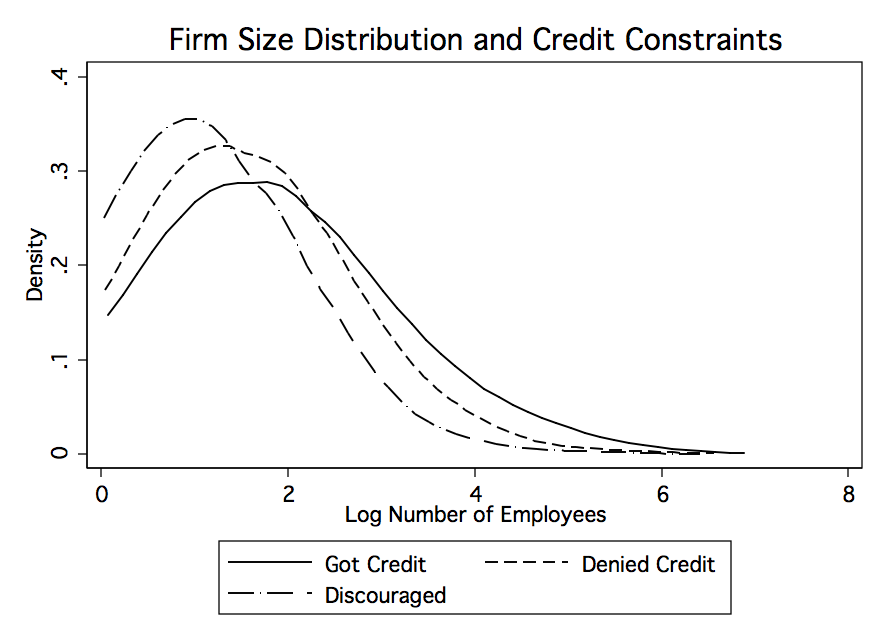

“Can Financing Constraints Explain the Evolution of the Firm Size Distribution?” Review of Industrial Organization (2016), Vol. 48(2), pp. 123-147. [link]

|

|

“Organization Matters: Trade Union Behavior in Peace and War.” Journal of Comparative Economics (2015), Vol. 43(4), pp. 919-937. [link]

|

|

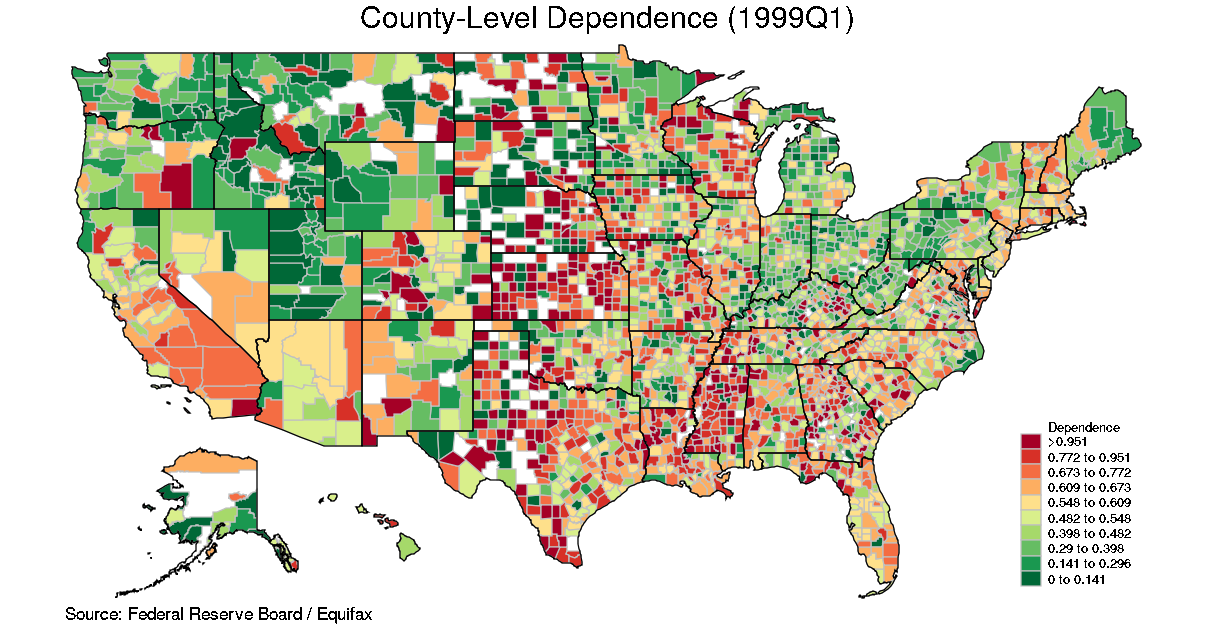

“The Unreliability of Credit-to-GDP Ratio Gaps in Real-Time: Implications for Counter-Cyclical Capital Buffers.” International Journal of Central Banking (2011), Vol. 7(4), pp. 261-298. [link] [FEDS WP] with Rochelle Edge

|

Articles in Edited Volumes

|

“How Britain Lost its Competitive Edge: Competence in the Second Industrial Revolution,” in Institutions, Innovation, and Industrialization: Essays in Economic History and Development (2015), edited by Avner Greif, Lynne Kiesling, and John V.C. Nye. Princeton: Princeton University Press, pp. 307-336.

|

|

“The Rate and Direction of Invention in the British Industrial Revolution: Incentives and Institutions.” in The Rate and Direction of Inventive Activity Revisited (2012), edited by Josh Lerner and Scott Stern. Chicago: University of Chicago Press, pp. 443-479. [NBER WP]

with Joel Mokyr |

Books

|

“Finanzmärkte, Corporate Governance, IuK-Technologien: Treibende Faktoren für den Wandel in der Industrie,” (Financial markets, corporate governance, and information technologies, 2003). ifo Beiträge zur Wirtschaftsforschung, vol. 11, Munich (with Hans-Günther Vieweg, Michael Reinhard, Alfons Weichenrieder, and Bent Nowak).

|

Working Papers

|

How Climate Change Shapes Bank Lending: Evidence from Portfolio Reallocation [link]

|

|

Nonbanks, Banks, and Monetary Policy: U.S. Loan-Level Evidence since the 1990s [link]

with David Elliott, José-Luis Peydró, and Bryce C. Turner |

|

The Dollar and Corporate Borrowing Costs

CEPR Working Paper No. 14892 [link] [CEPR WP] with Friederike Niepmann and Tim Schmidt-Eisenlohr |

|

The Research University, Invention, and Industry: Evidence from Germany 1760-1900 [link]

with Jeremiah Dittmar |

|

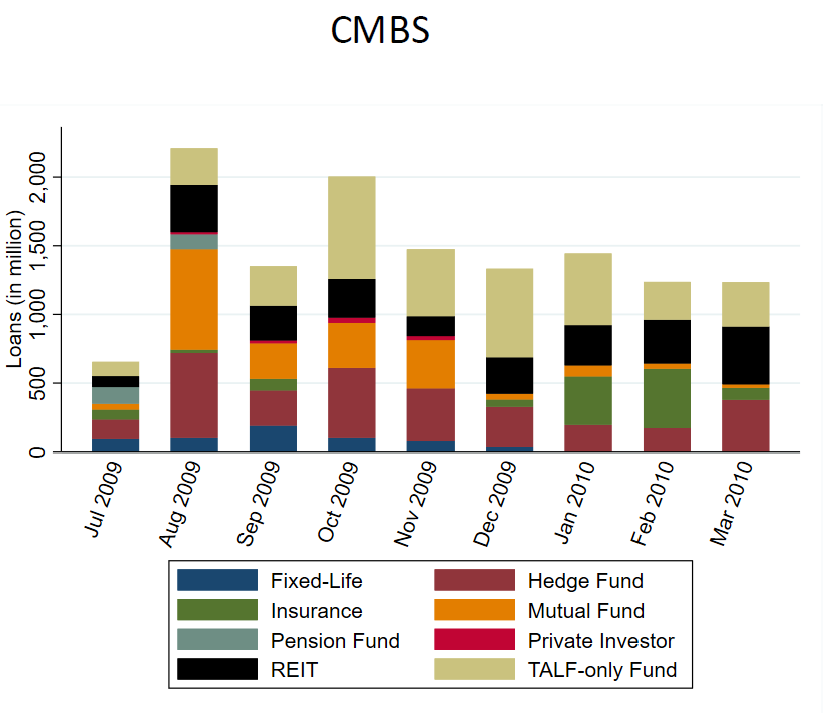

De-Limiting Arbitrage: Evidence from the Term-Asset Backed Securities Loan Facility [link]

with Karen Pence |

|

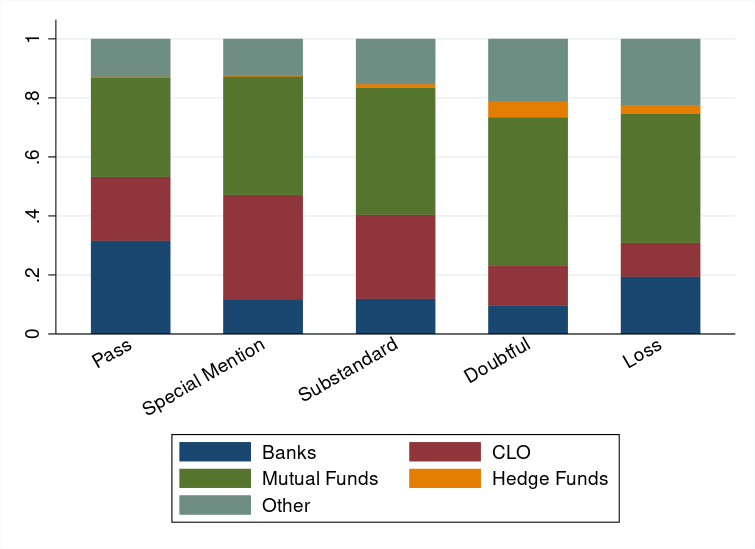

Changes in Ownership and Performance of Deteriorating Syndicated Loans [link]

with Marissunta Giannetti |

|

What do Lead Banks Learn from Leveraged Loan Investors? [link]

with Max Bruche and David Xiaoyu Xu |

Work in Progress

Miscellaneous Publications

"J. Bradford DeLong: Slouching towards Utopia: an economic history of the twentieth century Hachette Book Group, 2022" Book Review, Business Economics, 2023 [link]

"Internal Migration Patterns after the 2008 Financial Crisis: Evidence from a Credit Panel." (with Daniel Gallego), Chicago FED Insights, Nov 16, 2022.[link]

“How the Federal Reserve's central bank swap lines have supported U.S. corporate borrowers in the leveraged loan market” (with Annie McCrone, Friederike Niepmann, and Tim Schmidt-Eisenlohr), FEDS Note, November 12, 2020.[link]

“The lasting impact of epidemics” (with Jeremiah Dittmar), CentrePiece - The Magazine for Economic Performance 594, Centre for Economic Performance, LSE, November 2, 2020. [link]

“How Central Bank Swap Lines Affect the Leveraged Loan Market” (with Annie McCrone, Friederike Niepmann, and Tim Schmidt-Eisenlohr), Chicago Fed Letter, No. 446, September 2020.[link]

"The U.S. Syndicated Term Loan Market: Who holds what and when?" FEDS Note (with Seung Jung Lee, Dan Li, and Martin J. Sicilian), November 25, 2019.[link]

"Household Debt-to-Income Ratios in the Enhanced Financial Accounts" FEDS Note (with Michael Ahn and Mike Batty), January 11, 2018. [link]

"From credit risk to pipeline risk: Why loan syndication is a risky business" VoxEU.org (with Max Bruche and Frederic Malherbe), September 11, 2017. [link]

"Auto Financing during and after the Great Recession" FEDS Note, June 22nd, 2017. [link]

"Funding Agreement-Backed Securities in the Enhanced Financial Account" FEDS Note (with Nathan Foley-Fisher, Borghan Narajabad, Maria G. Perozek, and Stephane H. Verani), August 5th, 2016. [link]

"Impact of the ‘great bailout’: Evidence from car sales" VoxEU.org (with Efraim Benmelech and Rodney Ramcharan), June 11, 2016. [link]

"The origins of growth: How states institutions forged during the Protestant Reformation drove development" VoxEU.org (with Jeremiah Dittmar), April 26, 2016. [link]

“Off-Balance Sheet Items of Depository Institutions in the Enhanced Financial Accounts” FEDS Note, August 28th, 2015. [link]

“The Federal Reserve's Overnight and Term Reverse Repurchase Agreement Operations in the Financial Accounts of the United States” FEDS Note, March 24th, 2015. [link]

“Is education policy innovation policy?” VoxEU.org (with Joel Mokyr), June 13th, 2011. [link]

"Internal Migration Patterns after the 2008 Financial Crisis: Evidence from a Credit Panel." (with Daniel Gallego), Chicago FED Insights, Nov 16, 2022.[link]

“How the Federal Reserve's central bank swap lines have supported U.S. corporate borrowers in the leveraged loan market” (with Annie McCrone, Friederike Niepmann, and Tim Schmidt-Eisenlohr), FEDS Note, November 12, 2020.[link]

“The lasting impact of epidemics” (with Jeremiah Dittmar), CentrePiece - The Magazine for Economic Performance 594, Centre for Economic Performance, LSE, November 2, 2020. [link]

“How Central Bank Swap Lines Affect the Leveraged Loan Market” (with Annie McCrone, Friederike Niepmann, and Tim Schmidt-Eisenlohr), Chicago Fed Letter, No. 446, September 2020.[link]

"The U.S. Syndicated Term Loan Market: Who holds what and when?" FEDS Note (with Seung Jung Lee, Dan Li, and Martin J. Sicilian), November 25, 2019.[link]

"Household Debt-to-Income Ratios in the Enhanced Financial Accounts" FEDS Note (with Michael Ahn and Mike Batty), January 11, 2018. [link]

"From credit risk to pipeline risk: Why loan syndication is a risky business" VoxEU.org (with Max Bruche and Frederic Malherbe), September 11, 2017. [link]

"Auto Financing during and after the Great Recession" FEDS Note, June 22nd, 2017. [link]

"Funding Agreement-Backed Securities in the Enhanced Financial Account" FEDS Note (with Nathan Foley-Fisher, Borghan Narajabad, Maria G. Perozek, and Stephane H. Verani), August 5th, 2016. [link]

"Impact of the ‘great bailout’: Evidence from car sales" VoxEU.org (with Efraim Benmelech and Rodney Ramcharan), June 11, 2016. [link]

"The origins of growth: How states institutions forged during the Protestant Reformation drove development" VoxEU.org (with Jeremiah Dittmar), April 26, 2016. [link]

“Off-Balance Sheet Items of Depository Institutions in the Enhanced Financial Accounts” FEDS Note, August 28th, 2015. [link]

“The Federal Reserve's Overnight and Term Reverse Repurchase Agreement Operations in the Financial Accounts of the United States” FEDS Note, March 24th, 2015. [link]

“Is education policy innovation policy?” VoxEU.org (with Joel Mokyr), June 13th, 2011. [link]